WHY THE FUNDING CHALLENGE AND NEED FOR AN OPERATING REFERENDUM?

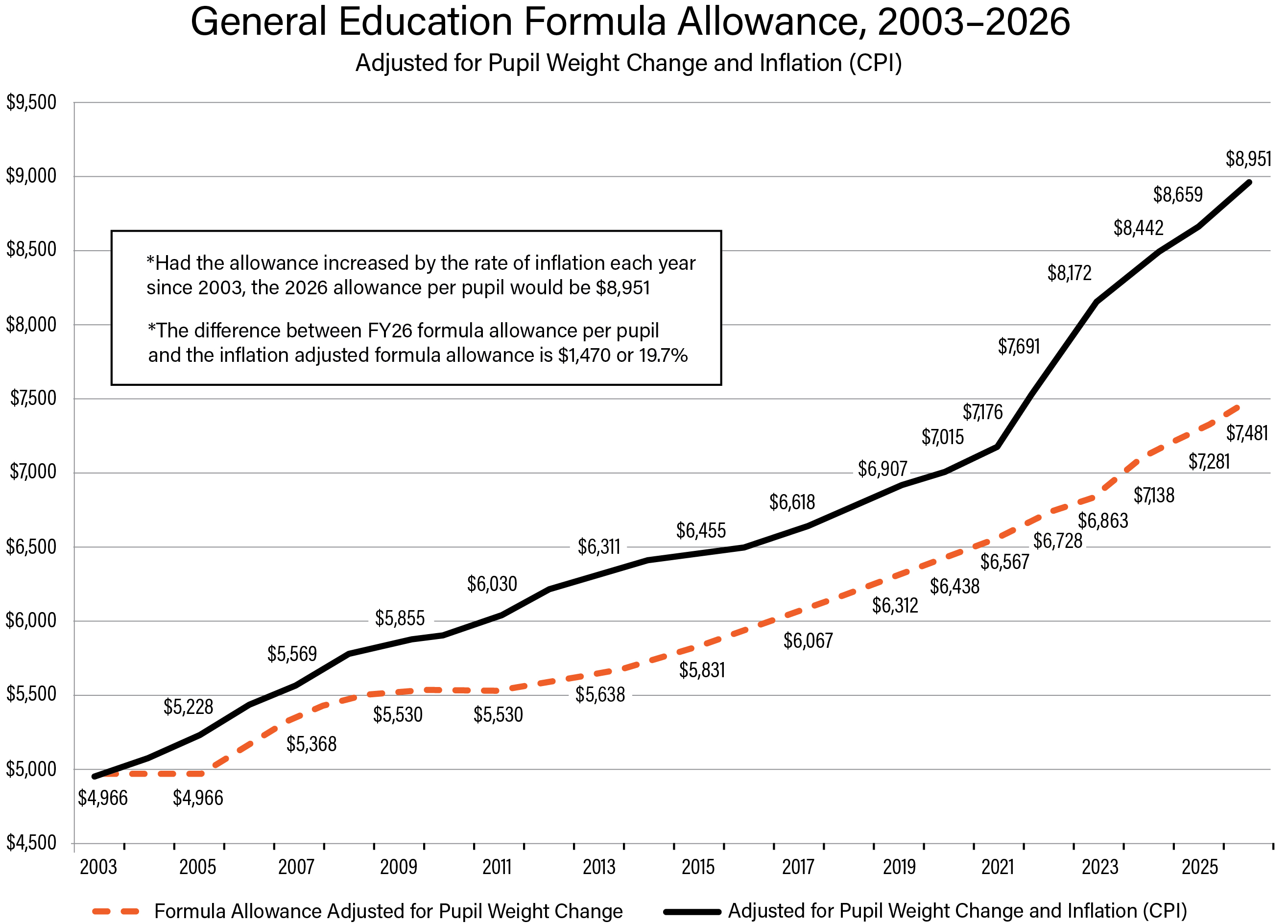

The cost to educate students increases every year due to inflation and increasing state and federal mandates. The primary revenue source a school district has comes from the state funding formula. This per student reimbursement has not kept pace with inflation, forcing school districts to do more with less. In fact, the District receives 19.7% or $1,470 less per student today than they did in 2003.

Due to the lack of funding from the State, most school districts have been forced to turn to local taxpayers to provide needed funding for school operations. 72% of Minnesota school districts rely on a local voter-approved operating referendum, averaging $1,147 per student [source: MDE]

The District has to follow new mandates including: additional course requirements, paid Family Medical Leave, unemployment, discipline requirements, and mandated teacher training. All of these requirements cost additional money that the District needs to reallocate from our already strained budget.

Special education services are not fully reimbursed. This costs the District an additional $500,000 each year.

The District has used fund balance (cash on hand) to balance the budget. This practice is not sustainable and no longer an option as a fund balance is needed to pay monthly bills without short-term borrowing.

WHAT WILL BE ON THE BALLOT?

The school board of Independent School District No. 391 (Cleveland) has proposed to increase its general education revenue by $750 per pupil. The proposed referendum revenue authorization would be applicable for ten years beginning with taxes payable in 2026, and increase each year by the rate of inflation beginning with taxes payable in 2027, unless otherwise revoked or reduced as provided by law. Shall the increase in the revenue proposed by the school board of Independent School District No. 391 be approved? YES NO By voting yes for this levy, you are voting for a property tax increase.

WHAT WILL THE OPERATING LEVY COST ME?

The figures in the table below are based on school district taxes for the new referendum revenue authorization only and do not include tax levies for other purposes

Type of Property: | Residential Homesteads, Apartments, and Commercial Industrial Property | |

Estimated Market Value | Estimated Taxes for Referendum Only | |

------------------------------- | Annual | Monthly |

$100,000 | $104 | $9 |

$150,000 | $156 | $13 |

$200,000 | $208 | $17 |

$250,000 | $259 | $22 |

$300,000 | $311 | $26 |

$350,000 | $363 | $30 |

$400,000 | $415 | $35 |

$450,000 | $467 | $39 |

$500,000 | $519 | $43 |

$600,000 | $623 | $52 |

$700,000 | $726 | $61 |

$1,000,000 | $1,038 | $86 |

The annual dollar increases for typical residential homesteads, apartments, commercial-industrial properties, and most other classes of property within the School District are as shown in the table above.

For agricultural property (both homestead and non-homestead), the taxes for the proposed referendum will be based on the value of the house, garage and surrounding one acre of land only. There will be no referendum taxes paid on the value of other agricultural lands and buildings. For seasonal residential recreational property (i.e. cabins), there will be no taxes paid for the proposed referendum.

Exercise Your Right to Vote On or Before November 4, 2025

Absentee (In Person) Voting

Friday, Sept. 19–Monday, Nov. 3 | 8:00 A.M.–4:30 P.M.

Le Sueur County Government Center

88 S Park Ave, Le Center, MN 56057

Election Day Voting

Tuesday, November 4 | 7:00 A.M.–8:00 P.M.

A voter must be registered to vote to be eligible to vote in the special election. Unregistered individuals may register to vote at the polling place on Election Day.

All qualified electors residing in the School District may cast their ballots at the combined polling place:

Cleveland City Hall

205 4th Street, Cleveland, MN 5601