Today, all 11th and 12th graders at Cleveland Public Schools had the opportunity to learn from field experts about financial planning for the future.

Students started with a “Reality Check-“ a program that takes the average salary of a students chosen career and measures it against certain lifestyle choices and their associated costs. Things like eating out, always having the latest technology, living in a large house, and other things are taken into consideration to give students an idea on if their desired career can support their desired lifestyle.

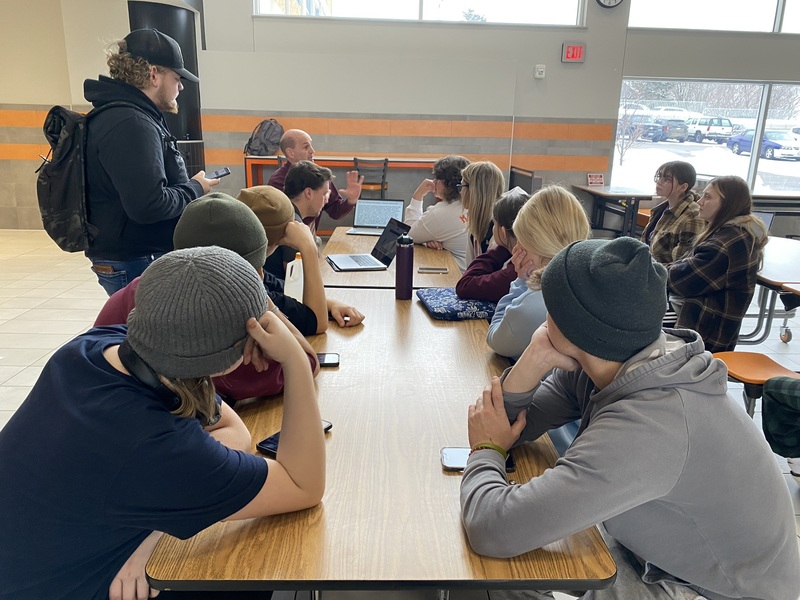

Students then split into groups to learn more about certain areas of finance. One area of emphasis included investments and the stock market, led by Social Studies instructor and assistant principal Mr. Cink. “I learned that there are ways to invest that are low risk,” shared a senior.

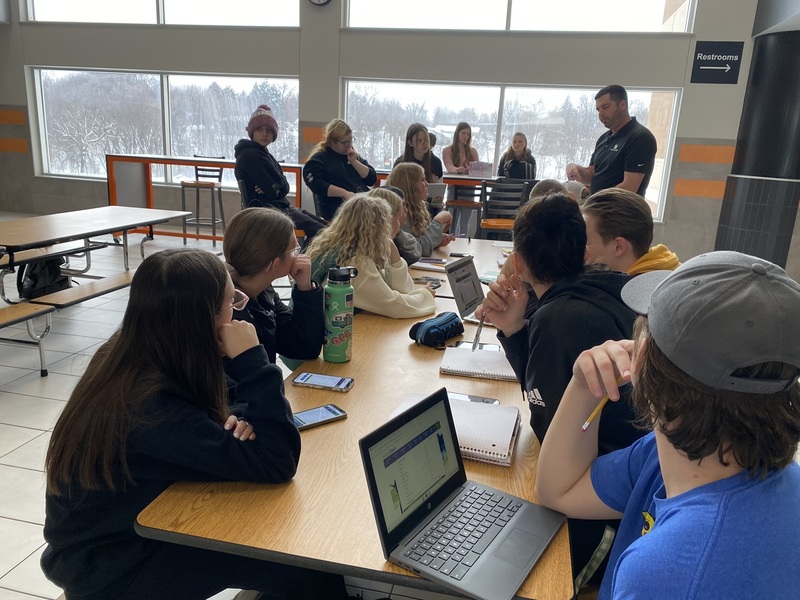

Another focus was general budgeting. Travis Mons from First State Bank came in to talk about the ins and outs of saving, how to allocate your paycheck, and how interest on credit cards and other loans can really add up.

The third concentration was credit and credit scores, taught by Sally Haase from Hometown Bank. Another senior was overheard saying, “Paying your credit card bills in full every month is a much better way to build good credit than only making the minimum payment.”

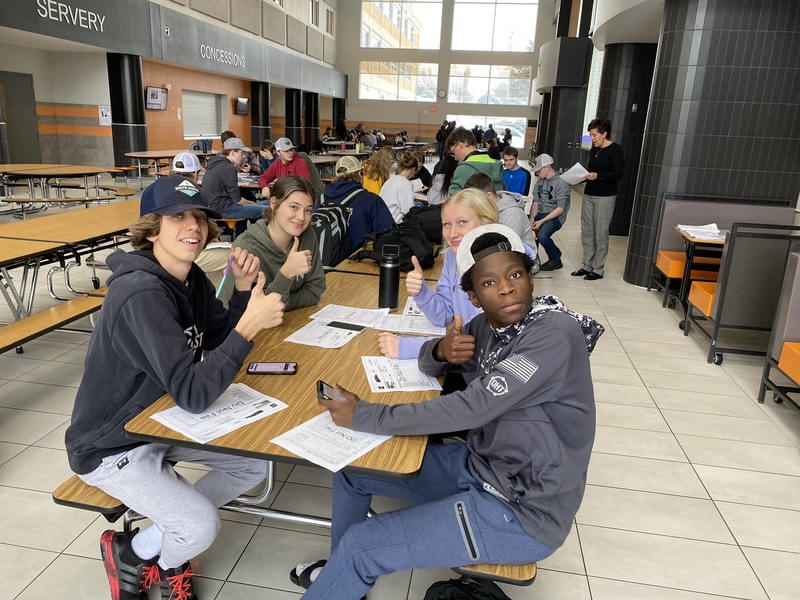

The final area of emphasis was taxes. Rita Paulsen, a certified personal accountant, led this session for students. They reviewed Form 1040 and talked about the process of filing a tax return. “My favorite topic was the stock market because it was interesting that you could make money just from owning something,” said junior Madison Peterson.

This event was planned by FFA Officers Sarena Remiger and Lilly Draheim, who were determined to take learning into their own hands. “These are things I know that I need to learn for the real world,” said Sarena. Lilly added, “I think all of these areas are things we need to know to be adults. I didn’t know what a lot of these things meant before today. I have heard things like 1040 before but didn’t really know what it meant.”

The event was deemed a success by many students, who talked about how it was a very eye opening experience that taught them how to be financially stable and responsible now and in the future.

Students are schooled in the stock market by Mr. Cink.

Students enjoy a credit- building Jenga game!

It's thumbs up from these juniors about tax returns!

Here, students engage in discussion about how interest can add up quickly!

From L to R: Sarena Remiger, FFA Vice President; Rita Paulsen, CPA; Travis Mons with First State Bank; Sally Haase with Hometown Bank; Mr. Cink, social studies; Lilly Draheim, FFA President